Help Toolbar (select a button to browse other online help sections) Home Tutorials Resources Search Tabs & Menus Button Bar Table & Data Display |

Entering an Employee's Tax Information

For this tutorial, we will show you how to define the tax information for your payroll employees. Each employee requires a number of settings that relate to how their taxes will be calculated in the payroll.

Before you begin: This tutorial assumes that you have already added a number of employees to your payroll. If you have not yet added your employees, you will not be able to edit their settings. Note: Employees cannot be added from this screen - you must do so in the Setup Employee screen. |

NOTE: Click on the images below to view them at full size

To define employee tax parameters:

-

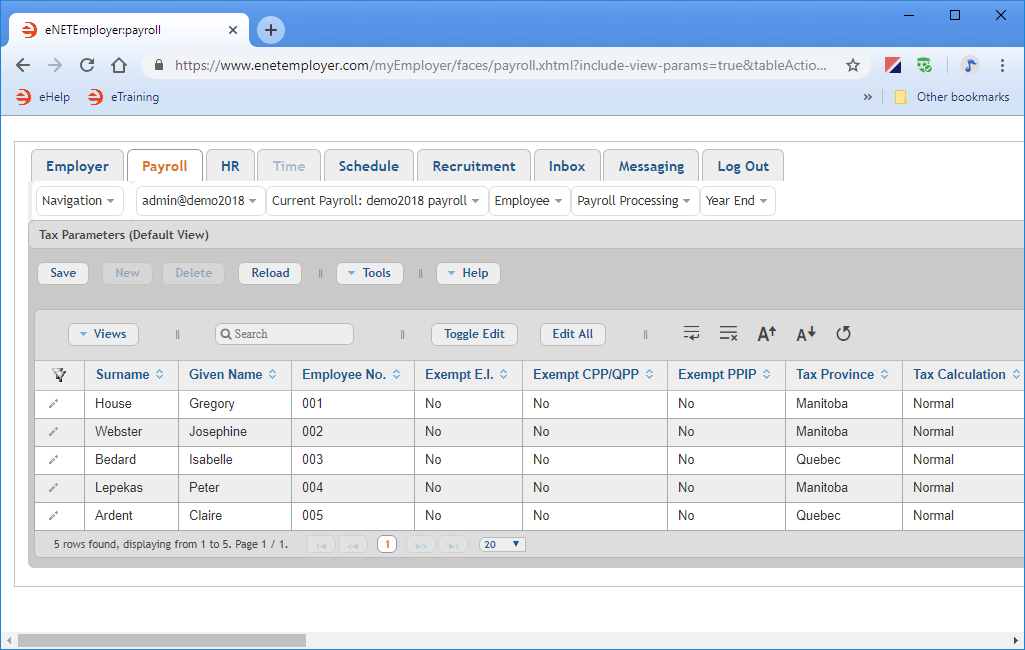

From the Payroll tab, open the Employee - Tax Parameters screen. This screen is used to define the detailed tax settings required for each employee in the payroll. You can use the various features to add and define settings for new employees or to review or change settings for existing employees.

- Double-click on the employee's row that you wish to edit. This activates Edit Mode so that you make changes to the cells.

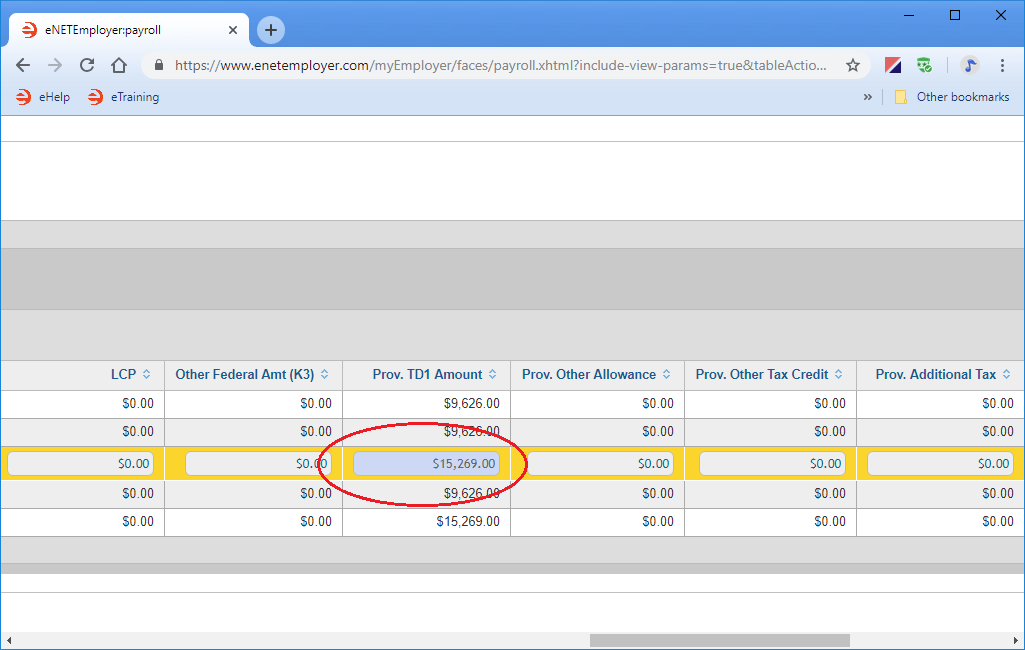

Example: In Fig. 01 below, we have edited the Provincial TD1 Amount cell for Isabelle to set the rate that corresponds to the province in which she works. - Continue editing the data for each cell as needed for the remaining employees in your payroll (press <F1> to use the Online Help system if you need to look up a definition for the various cells).

Example: In our example below, we have entered the tax information for five sample employees and have left a number of cells with the default values.

Employee Tax Province Provincial TD1 Amount Gregory House Manitoba $9,626 Josephine Webster Manitoba $9,626 Isabelle Bedard Quebec $15,269 Peter Lepekas Manitoba $9,626 Claire Ardent Quebec $15,269 - When you have finished entering your data, save the information for all of the rows.

Note: If you are working through the Quick Start Guide in order (or have completed the tutorials on adding employees - manually or with an employee template), the five employees that you created earlier will appear in the table along with a number of blank tax-related cells that need to be defined. As with other screens, you can enter the required data one row at a time, or you can activate Edit Mode for all of the rows at once and use the <Tab> key on your keyboard to enter the data in a more efficient manner. We will use the single-row method method for this tutorial.

This completes the tutorial on setting employee tax parameters.

Note: If you are working through the payroll setup process in order, you will need to continue through the Employee menu to finish entering the data that is required for each new payroll employee.

See Also:

- Setup Employee help page (Payroll tab)

- Adding Employees Using an Employee Template

- Adding Employees Manually

- Deleting an Employee

- Creating an ROE

Other Employee Settings:

- Employee address settings

- Employee's status settings (terminations, leaves, etc.)

- Employee payment settings

- Employee tax settings

- Employee bank accounts

- Employee earnings

- Employee deduction and benefit Items

- Employee accumulator items

- Working with an employee's YTD earnings

- Working with an employee's YTD deductions and benefits

- Working with an employee's YTD accumulators

- Importing employees from another payroll