Quickstart Menu (choose a topic to visit a section of the guide)Help Home | Step 1: Create Account Step 2: Company Setup Step 3: Payroll Setup Step 4: Add Employees Step 5: Process Payroll |

Quick Start Guide

Quick Start Guide

It's easy to set up your payroll with eNETEmployer. Use the following guide to complete the five basic steps that will walk you through the steps needed to process your first payroll!

eNETEmployer Payroll in Five Steps

(click on an option to expand)

This step involves submitting your basic company and contact information so that we can create your trial account.

- Sign Up - Visit our website and sign up for eNETEmployer - it takes less than a minute! Once set up, your unique login credentials will arrive in your email Inbox. Show Me...

This step involves defining basic company and contact information. Your company's contact information can be useful if we have any questions or concerns regarding your payroll or use of the eNETEmployer service. This section is broken down into several steps as shown below.

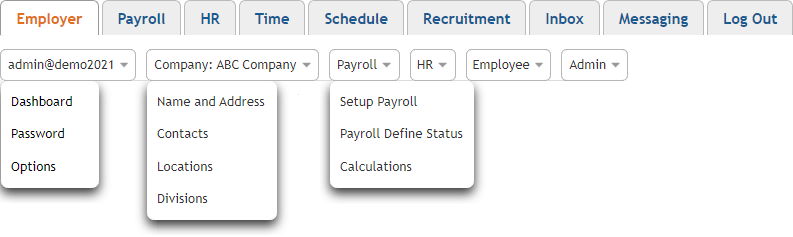

Here are some of the menus you will access during Step 2:

- Sign-In - Sign In to the eNETEmployer program. Show Me...

- Password - Define a secure password for your user account. Show Me...

- Options - Define your payroll user options. Show Me...

- Name & Address - Open the Employer tab and enter the your company's business name and address. Show Me...

- Contacts - Define your company's preferred contact/admin personnel. Show Me...

- Locations (Optional) - Define your company's location Information. Show Me...

- Divisions (Optional) - Define your company's division Information. Show Me...

- Setup Payroll (Optional) - Define settings for additional payrolls. Show Me...

- Payroll Statuses (Optional) - Create custom payroll statuses. Show Me...

- Calculations (Optional) - Define calculation Information for additional payrolls. Show Me...

This step involves setting up the various payroll items and settings that are required during the calculation process (earnings, deductions, accumulators, etc.). This section is broken down into several steps as shown below. Payroll details may also include several optional items, depending on the complexity of your payroll (EFT, Health, Templates, etc.)

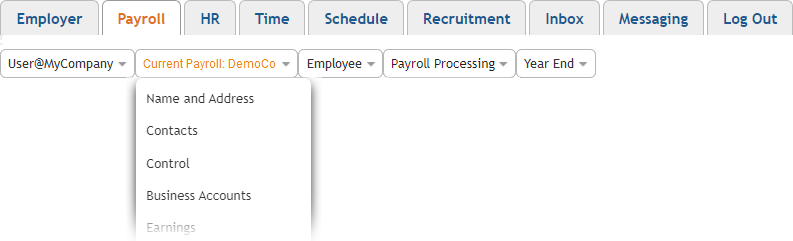

Here are the menus you will access during Step 3:

- Name and Address - Define the Name and Address settings for your payroll along with other basic payroll-related contact information. Show Me...

- Contacts - Define a payroll Contact person(s) if one should ever be needed. Show Me...

- Control - Define your payroll Control settings, such as the frequency by which you will pay your employees (e.g. monthly, semi-monthly, bi-weekly, weekly, and more). Show Me...

- Business Accounts - Setup your Business Number and the Business Account settings that will be needed for dealing with the Canada Revenue Agency or Revenue Quebec. Show Me...

- Earnings - Define the various Earning types that will be used for your payroll. Earnings records control the wages or salary for each employee. Show Me...

- Functions (Optional) - Define the various Functions that you may use in your payroll calculation (optional). Functions are mathematical formulas that can be used automate the calculation process. Show Me...

- Deductions (Optional) - Define various Deductions (over and above the default statutory Federal Tax, CPP and EI) that will be subtracted from the employee's pay. These include regular non-statutory deductions such as for dental plans, life insurance premiums, pension contributions, union dues, etc. Show Me...

- Benefits (Optional) - Define various taxable Benefits that may be applied to employees. For example, pension plans where the employer makes a matching contribution to the plan on the employee's behalf. Show Me...

- Accumulators - Define various Accumulators that will be used to gather/accrue amounts that will be used in various payroll calculations. These include such items as vacation pay where the amount owing to the employee is gathered over the year for eventual disbursement. Show Me...

- WCB (Optional) - Setup the rates and settings that will be needed when dealing with your provincial Workers' Compensation Board (WCB) . Generally, if your business is incorporated, or if you have any employees, you must register with your provincial WCB so that you can remit WCB insurance premiums. Show Me...

- Provincial Health (Optional) - Setup the rates and settings associated with your Provincial Health plan, where applicable (as of January 2015, only the provinces of Manitoba, Ontario, Quebec and New Brunswick have a provincially-regulated health plan). Show Me...

- EFT (Optional) - Setup your company's Electronic Funds Transfer (EFT) profile if you plan to pay employees via direct deposit to their individual banks or financial institutions. Show Me...

- Distributions - Setup the Distribution Codes that are used by the program to translate allocated hours and amounts that corresponding to a General Ledger (GL) entry. Many businesses prefer to use distributions to break down hours by department. Show Me...

- Employee Templates (Optional) - Setup employee Templates if you wish to simplify the set up process for new employees. Templates allow you to define the details needed for one staff member, and then apply them easily to many new members that share similar employment characteristics. Show Me...

This step involves adding your employees to the payroll and defining the settings for their individual payroll items (earnings, deductions, accumulators, etc.). This will also include their detailed tax, payment and other settings required for each employee during the calculation process. This section is broken down into several steps as shown below.

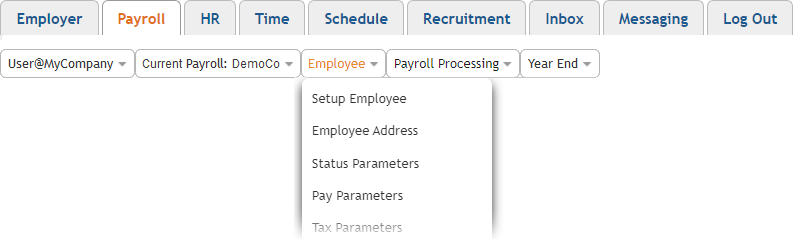

Here are the menus you will access during Step 4:

- Setup Employee - Add your employees to the payroll along with their personal information. Show Me...

- Earning Items - Define each employee's individual earning details (regular wages, vacation pay, statutory, etc.). Show Me...

- Deduction & Benefit Items (Optional) - Define each employee's individual deduction and benefit details (that are over and above the statutory Federal Tax, CPP and EI). Show Me...

- Accumulator Items (Optional) -Define each employee's individual accumulator items. Show Me...

- Year to Date Earning Items (Optional) - If necessary, define pre-existing earning values for each employee for year-to-date purposes. Show Me...

- Year to Date Deduction/Benefit Items (Optional) - If necessary, define pre-existing deduction/benefit values for each employee for year-to-date purposes. Show Me...

- Year to Date Accumulator Items (Optional) - If necessary, define pre-existing accumulator values for each employee for year-to-date purposes. Show Me...

This step involves entering the hours that your employees have worked for the current pay period (for hourly staff), and how to process your very first payroll! It will also include instructions on how to verify your payroll details before you close the period. This section is broken down into several steps as shown below.

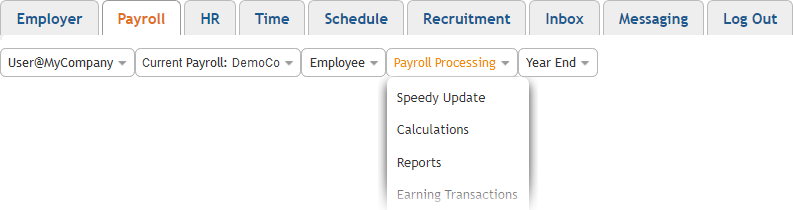

Here is the menu you will access during Step 5:

- Enter Employee Work Hours - Enter the hours that your hourly employees have worked for the pay period. Show Me...

- Calculate Your Payroll - Run a payroll calculation to calculate the numbers. Show Me...

- Review Your Payroll - Run the Payroll Register report to review your calculation results. Show Me...

- Backup Your Payroll - Create a payroll backup for security and storage purposes. Show Me...

- Close Your Payroll - Finalize the payroll and prepare for the subsequent pay sequence. Show Me...

- Payroll Reports - Generate your EFT, employee pay statements and other reports. Show Me...