Payroll Module

eNETEmployer allows you to easily manage your employee payroll processing and records including salaries, wages, bonuses, and deductions. Whether your company payrolls are simple or complex, eNETEmployer will make the employee payment process faster and more effective.

eNETEmployer allows you to easily manage your employee payroll processing and records including salaries, wages, bonuses, and deductions. Whether your company payrolls are simple or complex, eNETEmployer will make the employee payment process faster and more effective.

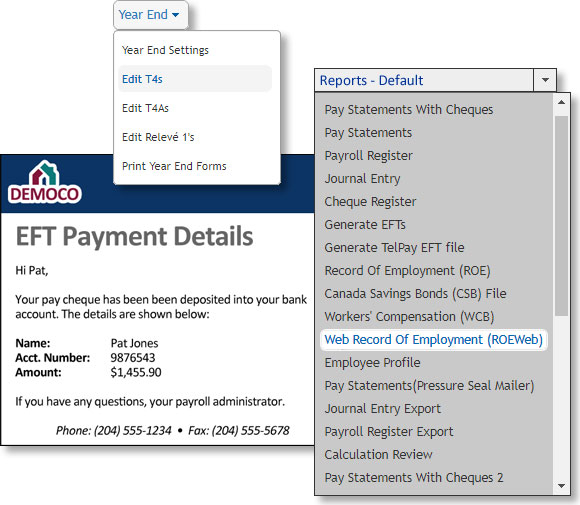

ROE's, T4's, EFT/Direct Deposit and more...

eNETEmployer includes all of the features you need to easily create employee Records of Employment (ROE). Year-end functions are also provided to produce employee T4 and T4A's. The Electronic Funds Transfer (EFT) feature (also referred to as Direct Deposit) allows you pay your employee's electronically by transferring funds directly to their bank accounts.

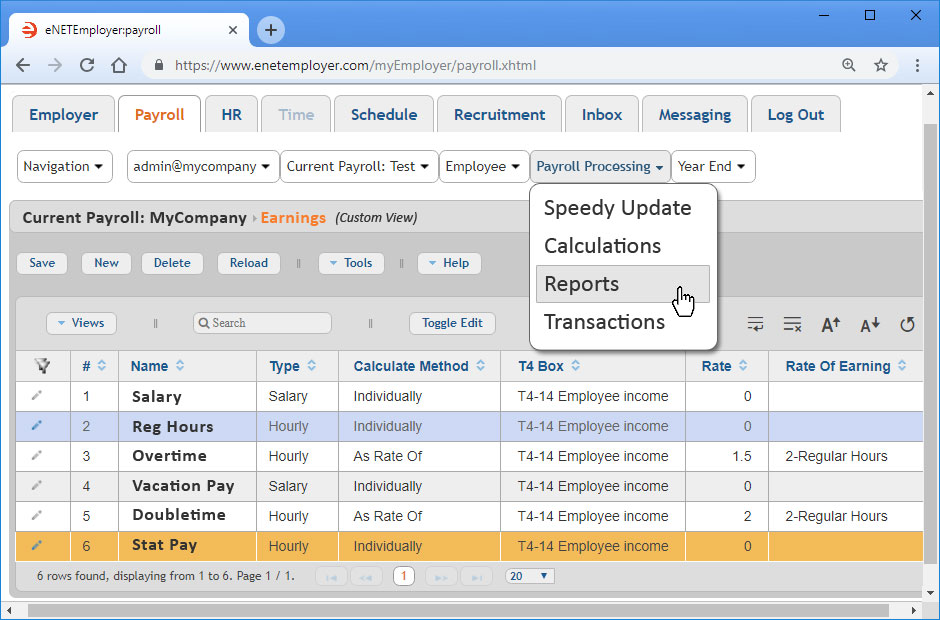

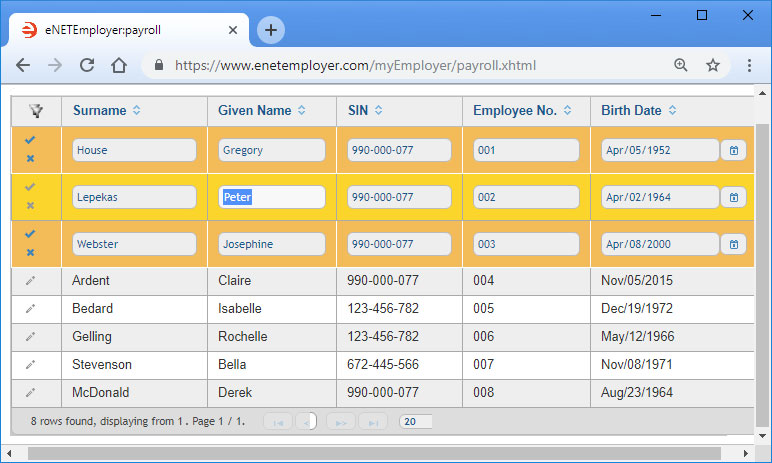

Innovative Spreadsheet Interface

eNETEmployer uses a familiar spreadsheet layout that allows you edit data in place, re-order columns, expand and collapse rows, and sort / filter data. Flexible formatting options add further capabilities that not only improve readability, but also make it possible to use the data in external reports and presentations.

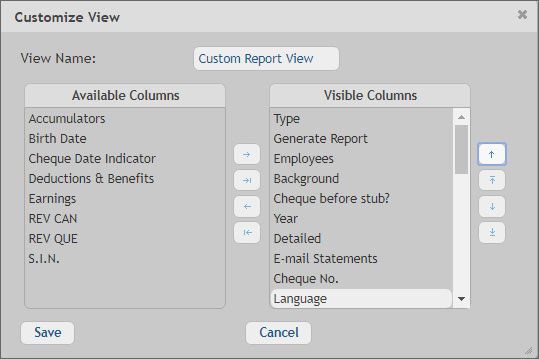

Customize Views

Use the program's unique Customize Views feature to tailor the data display in any order and from any aspect. Show additional columns to drill down for detailed data analysis or hide entire columns to facilitate quicker data entry. Custom views can be used to produce detailed reports that can be viewed onscreen or exported for external editing.

Module Features

eNETEmployer's basic pricing includes all of the features you need to pay your employees, including EFT. Everything from unlimited employees, interim payroll processing, extra or additional payroll runs, printed cheque or e-mail pay statements, employee self-service, customized reporting are included. Government and third-party remittances, ROE's and T4's are also available as add-ons so that you pay only for the level of service you require.

Read below to learn about the list of services included FREE with your service fee.

| Employee Features | Powerful Calculation Features | |

|---|---|---|

E-MAIL EMPLOYEE PAY STUBS INDIVIDUAL EMPLOYEE ACCOUNTS BI-LINGUAL SUPPORT |

UNLIMITED EARNINGS, DEDUCTION, BENEFITS AND ACCUMULATORS FLEXIBLE PAYMENT SCHEDULES |

|

| Customizeable Features | Third-Party Integration | |

USER-DEFINEABLE FUNCTIONS WORKERS COMPENSATION FAMILIAR SPREADSHEET LAYOUT |

DIRECT DEPOSIT / ELECTRONIC FUNDS TRANSFER (EFT) ACCOUNTING SOFTWARE INTEGRATION AUTOMATIC TAX CALCULATIONS |

|

| Year-End Features | Comprehensive Reporting Features | |

YEAR-END PAYMENT FORM DATA SIMPLIFIED TAX FILINGS T4, T4A AND RELEVÉ1 |

"PRINT ANY VIEW" CUSTOMIZED REPORTING DETAILED PAYROLL REPORTING |

|

| Security Features | Staff and Company Growth Features | |

USER-DEFINED ACCESS PRIVILEGES CURRENT WEB TECHNOLOGIES USER AUTHENTICATION |

TEMPLATES FOR NEW EMPLOYEES UNLIMITED REGULAR AND ADDITIONAL PAYROLLS EMPLOYEE GROUPS |

Choose the Get Started button or call 1-800-665-5129 to begin!

Would You Like Us To Perform the Payroll Process For You?

We can process your payroll from start to finish. Just email us each employee's work hours and we do the rest! This includes entering your employee work hours, processing the payroll, paying your employees via EFT/direct deposit, and then making the necessary government and third-party remittances. Use the table below to view our fee-based services. And as always, if you need something else - ask us!

Full Service Payroll Options |

|

|---|---|

EFT/Direct Deposit |

Web Record of Employment (ROEWeb) |

T4/T4A |

Manual Record of Employments |

Statutory remittances |

Self-sealing pay stubs |

Electronic Third-party Remittances |

Need something else? |

Looking for a Payroll Solution in Canada?

CanPay provides Payroll and Human Resource software and online solutions for thousands of companies across Canada. If your business has a unique payroll or HR need or you are simply looking for an alternative to your current method, contact us today. We can offer you a customized solution that will suit your unique business requirements. Please call 1-800-665-5129 or send a request e-mail to: sales@canpay.com.